Today I am attempting to write the greatest piece of writing in the history of man by focusing on the core currency that we all run out of: time.

In 1854, Henry David Thoreau wrote in Walden, “The mass of men lead lives of quiet desperation.”

In 2019, Joe Rogan brought this quote up with how most people live today.

You can’t live your life to the highest potential if you’re just trying to pay the bills and get by. The instant gratification choices, the indulgences, the purchases because you “deserve it” – they end up as credit card bills, car payments, and mortgages that compromise your ability to live a life of peace, freedom, and choice. The debts, the bills, the payments you need to make, end up dragging behind you like anchors – preventing you from pursuing your aspirations. Your financial choices change the compass of your life. You wanted to see your kid’s game, but you have a job and need to pay your bills. Your boss could fire you and then you couldn’t provide for your family. Valid dilemma. Your ability to not only earn income, but manage your money well enough to be able to live the life you want is completely within your control. Do you want to live a life of quiet desperation like this guy?

If you could receive 1 Billion dollars, but you’d have to miss the next 20 years of your life – would you do it?

You don’t get time back. You can always make more money, but you can’t make more time.

We all have different values, philosophies, goals, and aspirations. This post is not to preach, to pigeonhole, to tell you what to do with your time and money. Ultimately, you need to decide what you value most – you can then make choices that are built around what you value.

In America, we have a dopamine problem. We always need more, more, more. We’re constantly marketed to. There’s a new product or service that can take care of your problems. There’s always something new that you may think you need to be happy. Marketers are very good at portraying a product or service as something you need and ratchet up the urgency with a timeline. It’s Black Friday, Cyber Monday, end of the year, President’s Day, Hurry Up! Product is running out! Get yours now!

How much is enough? What do you really need? Is your lifestyle in line with your values? I’ve heard the ‘outward searching for more’ line of thinking described in the psychology world as the “If, then” principle. If I get that car/house/cell phone/new clothes – then I’ll be happy. This is a marketer’s dream, especially in a capitalistic society like America. There’s always a new product or service that will make you “happy.” Going further, If-Then thinking also applies to big life events and decisions. If I get that job/that house/that spouse/children/that raise – then I’ll be happy. More or new is not always the solution. Novelty doesn’t last. More often the better solution may be less, or simply taking the time to be thankful for what you have right now.

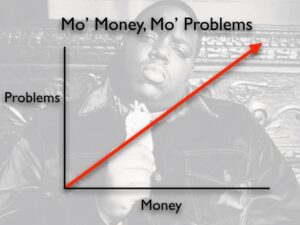

A good story that illustrates lifestyle choice is the story of the fisherman and the businessman. You can spend a lot of your time building a business, more revenue, more employees, more growth, more, more, more…just to get where you are right now. Would all that effort and wasted time be worth it? As the great Biggy Smalls said, “Mo Money, Mo Problems.”

I’ve also heard Kevin O’Leary from Shark Tank say, “If you have enough money to take care of a problem – you don’t have a problem.” So who’s right, The Notorious One or Mr. Wonderful? Well, I think they’re both right in a way because I just put them both in this post. As people make more money, “Lifestyle Creep” can take hold – you start to eat out more, buy more stuff, get a new car with a larger car payment, and subscribe to more streaming services. But what happens if you lose your job or become disabled? The bills still need to get paid.

There’s a fine balance between money and time. There’s the popular phrase “time is money”. True to a degree. But a step further would be “time is wealth”. Back to the Billion-dollar question – would you trade 20 years for the money? Some may say yes, and that’s your choice, it’s a billion dollars, but I ultimately feel most of us would regret 20 wasted years. It works that way for many choices we make. Sitting around, scrolling through the newsfeed, working a job you don’t like to pay bills for stuff you don’t need – what do you think your future self will think of the decisions you’re making now?

That is a great question to ask yourself when making some decisions now – what will I think about this choice 20 years from now? Will you regret not attending a wedding or a funeral? I know I regret when I couldn’t make it to big events like that for others. Sometimes the importance of an event is more important than your savings goals or retirement plans. Years ago, my girlfriend at the time (Wife now) was invited to a wedding in Malaysia. My Wife went to college in Canada and was considered an international student, so she made friends from all over the world. Had we budgeted to go to Malaysia that year? Nope. But we went, and it was a trip of a lifetime. We had some experiences we’ll likely never have again. Do you think I’ll look back on my past self and have the same memories of how much money was sitting in my savings account?

Time is also unequal when it comes to your life situation and health. In Tim Ferriss’, The Four Hour Work Week – he argues that time in your 20’s or 30’s is not equal to time in your 60’s or 70’s. You can do a lot more physically in your 20’s and 30’s for the most part. Instead of deferring retirement where you work your whole career and retire later on, he advocates taking mini-retirements and enjoying time now. Tomorrow is not guaranteed, let alone 30 years from now.

There’s a balance you need to walk. Am I saying you should rack up your credit card and gallivant around the world because you’ll never regret it? No, but it’s important to be able to weigh what is most meaningful to you at that point. When to push and when to relax. Ideally, you’re making decisions that are in your best interest the majority of the time and you splurge every now and then. Unique events and opportunities are going to come around every now and then that don’t exactly line up with your life goals and you’ll have a decision to make.

Some decisions make many future decisions for you. Career choices, getting married, where you live, having kids, getting a dog, buying a house, or starting a business. Regardless of how you feel in the morning, your child and dog will be waiting for you to feed them. Commitments you make such as working a job, getting married, or promising a bank that you’re going to pay the mortgage – they’re not one-time decisions. You need to show up every day. Commitments you make today – account for your time and money in the future as well. Again, it’s your ability to make choices that are in line with your values. Each of these decisions will shape your life. You need to think through the future lens – years from now – how do you think these decisions will play out?

There are seasons to your life where your choices may be different as well. You may be fine with working longer hours or building a business when you’re young or after the kids have left the house. My Wife and I currently have three kids, age 7 and under. We made many decisions that have led to us having as much time with our kids as possible. We decided my Wife was going to stay home full-time when we had our second child. I’ve changed my career to not be on the road as much anymore. Have we always been perfectly happy? No. Have there been some difficult times? Yes. But most days we have 3 meals together. How do children spell love? T – I – M – E. We can always go make more money, but we’ll never get this time back.

So what do you do with your time? What is most important? We could all just spend time with our families and friends enjoying time together, but that doesn’t pay the bills either. Maybe the goal isn’t just to pay the bills. Maybe you want to run an influential business, be a professional athlete, or actor. Whatever it is, you want to thrive. Not just get by. That’s a good way to think. The Japanese have a word called Ikigai (pronounced ee-kee-guy) that is pretty interesting. In Japanese culture, Ikigai means that you’ve aligned what you love (passion and mission) with what the world needs (vocation). It is your reason for being, your inner purpose. The intersection of your passions, skills, and vocation. That can be a hard thing to do lining those all up, but it’s possible. You may need to keep learning new skills or start a business yourself, but you can have ikigai in your career.

Is your goal to make money? Or something bigger? To do the big things, you need to do the small things first. You have to work your way up Maslow’s hierarchy of needs. If you want to change the world and leave a lasting impact, you’ll probably need to be able to provide shelter and food for yourself first so that you can be in a place to go after those large aspirations.

When it comes to managing your personal finances, we recommend budgeting your money with a zero based budget, paying yourself first, and being intentional with how you save, invest, and spend. I would advocate that even more so with your time. Just like a money budget, you should also do a time budget. How much time have you spent at work, commuting, with friends, with family, pursuing hobbies, with your spouse, with your kids, exercising, or sleeping? Where are you out of whack? Budgets are not meant to be a set-it-and-forget-it solution. You need to adjust and recalibrate. Your life is going to keep changing. You may be killing it in your career and earning more than you have, but are you time-poor in other important areas of your life? That is for you to weigh out. There is an opportunity cost with each decision. You may decide to make a commitment for a season that is best for you and your family, but just make sure you keep evaluating and be ready to adjust.

Now, the ultimate test – The funeral test. Who will show up at your funeral? How will you feel in your last days as you reflect on your life? Who will be sad when they learn you’ve passed? What will your legacy be? How will you be remembered? What relationships did you develop? What organizations did you commit your time to? What did you do with your free time? The decisions and choices you make all ultimately culminate here.

There is a popular book called, “The Top Five Regrets of the Dying – A Life Transformed by the Dearly Departing” by Bronnie Ware. According to Bronnie, the five most common regrets were:

“I wish I’d had the courage to live a life true to myself, not the life others expected of me.”

“I wish I hadn’t worked so hard.”

“I wish I’d had the courage to express my feelings.”

“I wish I had stayed in touch with my friends.”

“I wish that I had let myself be happier.”

Notice none of these regrets were:

“I wish I had negotiated a higher raise:

“I wish I had gotten a higher % return on my investments”

“I wish I spent more time on my phone writing emails on the weekend”

“I wish I went to more networking events”

“I wish I spent more time at work”

You have one life to live. The ultimate currency you have is time. Notice that none of the top regrets were money-centric. Being true to yourself, not working as hard, expressing your feelings, staying in touch with friends, and letting yourself be happier. What choices can you make now that will allow you to live that type of life?

![]()

OTHER RELATED TOOLS AND ARTICLES YOU MAY BE INTERESTED IN:

Financial Tools: The Pros & Cons of GoodBudget

Financial Tools: The Pros & Cons of YNAB

Financial Tools: The Pros & Cons of EveryDollar

![]()

A Journey to Personal Financial Success

At Morgan Franklin Foundation (MFF), we support the concept of financial freedom – by teaching participants how to save by paying themselves first, invest for their future and grow their net worth.

Learning how money works and how to talk about money with others are the first steps towards recognizing an individual’s lifelong financial goals. Our online programs, podcasts, blogs, and book reviews and resources are designed to help you learn the concepts, rules and vocabulary of money, finance and investing.

Becoming an MFF Fellow

Our Standards of Financial Literacy – Learning about money series is engaging, full of interesting information, and easy to navigate. Adapted from the National Standards for Personal Financial Education developed by the Council for Economic Education (CEE), this robust curriculum features six short lessons on such important topics as earning income, understanding the value of saving and using credit. When completed, this program lays the foundation for becoming an MFF Fellow.

Becoming an MFF Fellow is the ticket to access additional MFF programs and opportunities for mentoring, networking, internships and real-world opportunities. Hear from the MFF Fellow themselves on how these opportunities encourage them to continue their journey to personal financial success.

Learn More about Money

Begin the journey towards personal financial independence today. START LEARNING TODAY