One of the core principles of a college education is critical thinking. Question your sources. Question what you’re reading. What is the motive of the author or organization? Are you reading facts with quality sources? Or is it opinion? What is the author’s experience with the information they are presenting?

Information has become very easy to create and share. You no longer need to be a professional journalist, who has vetted an investigative report, to publish thoughts in the newspaper or report thoughts on the nightly news. Anyone and everyone can share what they’d like – true or not.

So how does one find good, credible information today? On the internet, of course. Google it. Dig up the Wikipedia page. There are plenty of good sources, right? But how do you decipher between good, credible information and less-than-credible sources? This post intends to dig into financial blogging, marketing, credibility, and technology’s integration into our lives and consumerism.

It can sometimes be hard to make good decisions in general, let alone – good financial decisions. There are so many options out there. In a capitalistic society, we are bombarded with advertising. With so many options, advertisers are evolving to get your attention. One successful way to do this is affiliate marketing. There are many individuals and companies creating content that looks like good, credible advice, but they are actually affiliate marketers.

They are recommending products or services based on your search criteria. Affiliate marketers employ specific tactics such as paying for search keywords and writing content strategically with search engine optimization (SEO) that help search engines like Google find their posts. The companies that offer the products and services they are “recommending” are paying the affiliate marketer a commission for recommending their product and service.

For example, I just searched Google, “Best HELOC Rates” and got the following after scrolling past the sponsored ads up top:

Well, these options look pretty good. How about NerdWallet? They seem like a good, credible source. Nerds are smart. I have a wallet. I believe I saw they had a Super Bowl ad last year. Top Lenders in my area? That sounds like what I’m looking for.

Interesting. I’ve never heard of any of these lenders. I don’t think I’ve seen a physical location for any of these banks in my state (NH). Figure is out of NC, Bethpage is out of NY, and New American Funding is out of CA. Now, Bank of America and TD Bank aren’t based in my state either, but at least I see their local branches. Lenders do operate differently than a traditional bank that offers banking services to local residents. But I have inside information. I worked for a real estate law office for years closing real estate loans. I met with customers to close refinances and purchases and did over 1,000 transactions in my state. I have never heard of any of these lenders that NerdWallet was recommending. You’d think I would have seen at least one of these lenders if they were a top lender?

As I entered various search keyword strings to find what lenders were actually the top lenders in my area, I came across countless affiliate marketing websites all trying to recommend different lenders for a commission. I was finding more lenders I had never heard of. It was hard to find a credible website that objectively ranked lenders based on reviews, volume, or loans underwritten. Even the credible-looking sites weren’t credible: CNN, Forbes, CNBC, USNews – they were all littered with affiliate links and advertising.

So what am I actually looking for? A website that has evidence, data, facts, sources, reviews. Doesn’t have a bunch of links or advertising. Not quick to recommend other products or services. There would be little opinion. In my initial searches, I could not find a website like this. There is just so much noise on the web. Ok, dead horse beaten.

Back to NerdWallet. Why would NerdWallet be showing me these lenders as “Top Lenders” in my area? What are the criteria for being a Top Lender? To me, Top Lender would mean lenders that produced the most loans or volume in my area to warrant being recommended as a Top Lender.

I became curious and researched advertising on NerdWallet. Here’s what they had to say:

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

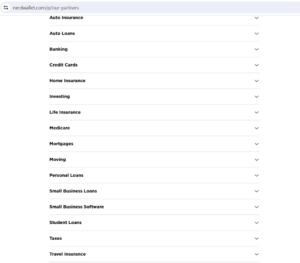

Ok, that makes sense – I think. NerdWallet still presents researched advice but also gets paid by companies to partner with them. But where and how? How do I know where research ends and paid advertising begins? Their partners may influence what products they review and write about? It looks like the search I just did are all paid partners since I’ve never seen any of them in my area and they must be paying NerdWallet to show them over other more recognizable lenders in my area who aren’t partners of NerdWallet’s. I wonder how many partners NerdWallet has? They list them all by category:

Wow, that’s a lot of categories. These companies must get a lot of exposure for that many companies to want to partner with NerdWallet and get on their site. Some of the categories only have a few partners such as 3 for Auto Insurance, 12 for Life Insurance, and 3 for Taxes. But once you start to get into some profitable, competitive categories: Banking – 22, Credit Cards – 22, Investing – 37, Personal Loans 416, and Mortgages – 4,881. 4,881 different lenders are paying NerdWallet to be on their site! Wow. No wonder I’ve never heard of any of these recommendations. This took me a while to count. Take a look at them all here: NerdWallet Partners.

That’s the case for many different searches you’ll find on Google. NerdWallet is one of the leading affiliate marketing websites on the internet, but is just one example. Countless pages and apps are doing the same thing. Beyond Google searches, you may come across products or services by email, social media, an app push notification, or countless other ways.

Affiliate marketing isn’t necessarily all bad, marketers do have value in our society in coming up with creative ways to get the right product or service in front of the right people. In many cases, that product or service could help those people. And hey, if companies will pay you a commission to share their stuff, that sounds like a nice business to be in. As an affiliate marketer, you don’t need to start the business, hire a bunch of people, take the risk of buying or making all the products. If you’re interested in learning more about affiliate marketing, Hubspot does a deeper dive on how that business works.

The Advancement of Technology and Marketing

So, how did we get here? Well, here’s my personal, historical account loaded with opinion. I take joy in the fact that as a geriatric millennial, I’ll one day be able to tell the youngsters what the world was like without smartphones, high-speed internet, or social media.

We live in a capitalistic society. Advertising isn’t new. It has just changed and grown. The internet created a whole new powerful medium for companies and marketing. As the internet has grown, so have new marketing opportunities. The World Wide Web started with banner ads, sidebar ads, and pop-ups. American Online or AOL was very popular in the 90’s which got a whole new generation of people dialing onto the web with a 14.4 modem in chatrooms introducing themselves with their A/S/L. But if Mom picked up the phone – you were booted off. Your rich friends with 56k modems had it good back then. As technology quickly developed into high-speed internet and eventually wireless internet – it became easier for us to be continuously connected to the web.

One of the larger jumps for technology and marketing was the smart phone. As high speed, wireless internet became abundant and people could access this from their phones – it became ubiquitous with modern society. Software and application development for smart phones quickly started replacing several tools: cameras, flashlights, calculators, etc. There have been profound studies on how smart phones have dramatically shifted benchmarks for an entire generation. Specifically, Jean Twenge’s 2017 article in The Atlantic and follow-up book Have Smartphones destroyed an Entire Generation? is credited with coining Generation Z as “the iGen”.

With the development and growth of social media, every person can now become an influencer. With enough followers, a company may pay you to advertise their product or service to your following. In fact, some 57% of Gen Z believe they can make a career out of being an influencer. It wasn’t always this complicated and monetized. I was one of the first cohorts of users of thefacebook.com in the Fall of 2004. Back then, it was only for college students. I actually preferred Myspace. Couldn’t set your own tailored song, pick your top 8 friends, or design your own page on Facebook. But you could poke people on Facebook. If only Myspace came up with the Poke feature, the world may be different today.

According to USC, we’ve gone from seeing 500 ads a day to 5,000 ads a day. The advertising is getting smarter and in some ways more subtle. Our smartphones have become an extension of our brains. People are lost without their phones. This is a marketer’s dream. Marketing has become more about data and technology. Your phone collects a lot more about you than your TV or radio did. With more data, marketers can tailor the right product or service to you.

Big tech companies like Apple, Google, Facebook, and Amazon are trying to learn as much as they can about you so they can monetize that relationship. Either by designing products or services that you need or creating an advertising environment where other companies can market to your specific demographic. One of the more important and concerning documentaries recently I’d recommend watching is The Social Dilemma. A memorable quote that sticks with me from the documentary is when Google’s former design ethicist and Co-Founder of the Center for Humane Technology, Tristan Harris, states, “if you’re not paying for the product, then you are the product.” These companies are profiting from you using their platform and allowing advertisers to market to you. They have intentionally designed their apps and services to be as addictive as possible to keep you on there as long as possible.

Social media can be one of the most influential and divisive places you can spend your time on. Not only are you constantly being advertised to by companies, but your own friends and families are too. Your Uncle John sharing his political stance and your neighbor wants you to buy Girl Scout cookies. We as people are all in the sales business. When you recommend a movie or a restaurant – you can influence someone else’s decision. You influence others by where you live, what you do for work, what you spend your free time doing, or what you drive. With that said, there are a lot of opinions and highlights of other people’s lives on these apps. This can cause you to feel worse about your life, make you want to keep up with the Joneses or cause you to make irrational decisions. If you find yourself feeling this way, try to limit your screen time or stop using some of the apps altogether.

So what does this all mean for your finances and your decision-making? Well, we live in the most interconnected and distracted time in the history of humans. It means you need to have more conviction and discipline in your own goals and values. You need to create a budget for your lifestyle, cut out the distractions, and put your blinders on to anything that pulls you away from your goals. Companies and marketers have gotten smarter and they’re competing for your attention and your dollars. Picture yourself walking around with a bucket full of cash and all these marketers are trying to snatch your cash – you gotta protect it! If you find yourself making impulsive decisions, spending recklessly, or mindlessly scrolling or shopping – maybe put the phone down, delete the app, or set time limits. Be careful where you get your information from. There are a lot of good sources out there, it just takes a little longer to find the good ones. You have one life to live – you don’t want to look back and think you spent most of it on your phone buying stuff you didn’t need.

![]()

OTHER RELATED TOOLS AND ARTICLES YOU MAY BE INTERESTED IN:

Financial Tools: The Pros & Cons of GoodBudget

Financial Tools: The Pros & Cons of YNAB

Financial Tools: The Pros & Cons of EveryDollar

![]()

A Journey to Personal Financial Success

At Morgan Franklin Foundation (MFF), we support the concept of financial freedom – by teaching participants how to save by paying themselves first, invest for their future and grow their net worth.

Learning how money works and how to talk about money with others are the first steps towards recognizing an individual’s lifelong financial goals. Our online programs, podcasts, blogs, and book reviews and resources are designed to help you learn the concepts, rules and vocabulary of money, finance and investing.

Becoming an MFF Fellow

Our Standards of Financial Literacy – Learning about money series is engaging, full of interesting information, and easy to navigate. Adapted from the National Standards for Personal Financial Education developed by the Council for Economic Education (CEE), this robust curriculum features six short lessons on such important topics as earning income, understanding the value of saving and using credit. When completed, this program lays the foundation for becoming an MFF Fellow.

Becoming an MFF Fellow is the ticket to access additional MFF programs and opportunities for mentoring, networking, internships and real-world opportunities. Hear from the MFF Fellow themselves on how these opportunities encourage them to continue their journey to personal financial success.

Learn More about Money

Begin the journey towards personal financial independence today. START LEARNING TODAY