Morgan Franklin Fellowship Foundation

Mid Quarter 2020 Economic Outlook

Written by: Elizabeth Salas Evans, President & CCO at Cayena Capital Management

March 12, 2020

Just yesterday, German Chancellor Angela Merkel dismally provided her warning that 70% of Germany’s population is at risk of contracting COVID-19 (Coronavirus), and the World Health Organization (WHO) has declared COVID-19 a pandemic. This health crisis provides a great example to the economic impacts regarding supply and demand.

Just yesterday, German Chancellor Angela Merkel dismally provided her warning that 70% of Germany’s population is at risk of contracting COVID-19 (Coronavirus), and the World Health Organization (WHO) has declared COVID-19 a pandemic. This health crisis provides a great example to the economic impacts regarding supply and demand.

We will see increasing volatility and further declines across global equity (stock) and credit (bond) markets, particularly as we continue to see an increase in cases of COVID-19 and further shocks to the supply chain as companies scramble for ways to deliver products, with demand sinking for travel and hospitality.

Supply Side Impact

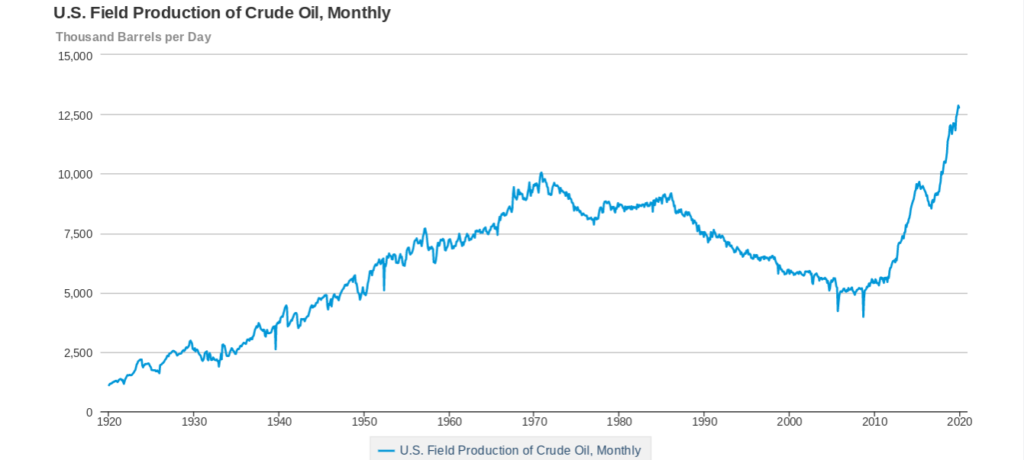

Saudi Arabia and Russia, two of the world’s largest oil producers, stepped away from a deal to regulate prices within the market. They both flooded the market, increasing supply of oil, which drove prices down over twenty-five percent on Monday. The below chart reflects historical oil production within the U.S., with the largest increase occurring over the past twenty years.

This has created greater competition within the Organization of Petroleum Exporting Countries (OPEC), which has led to a threat of reduced market share for countries such as Saudi Arabia and Russia. With U.S. companies increasing their debt as borrowing costs are low, the risk of lower prices for longer periods of time will increase the potential for layoffs, which could slow production further.

Demand Side Impact

Yesterday, President Donald Trump announced a travel ban between Europe and the United States, with the exception of the United Kingdom. The uncertainty around the spread of COVID-19 has brought demand for the Travel and Tourism industry to a standstill. An example is the cruise ships buoying off the coast of the U.S. with passengers under quarantine. With few people traveling, eating out, and attending events including weddings, this reduces the demand for the industry, which in turn reduces their ability to make money. On the bright side, cheaper fuel costs!