Household and personal income is defined as “the sum of all the wages, salaries, profits, interest payments, rents, and other forms of earnings received in a given period of time.” Simply put, it is all the sources of money you receive.

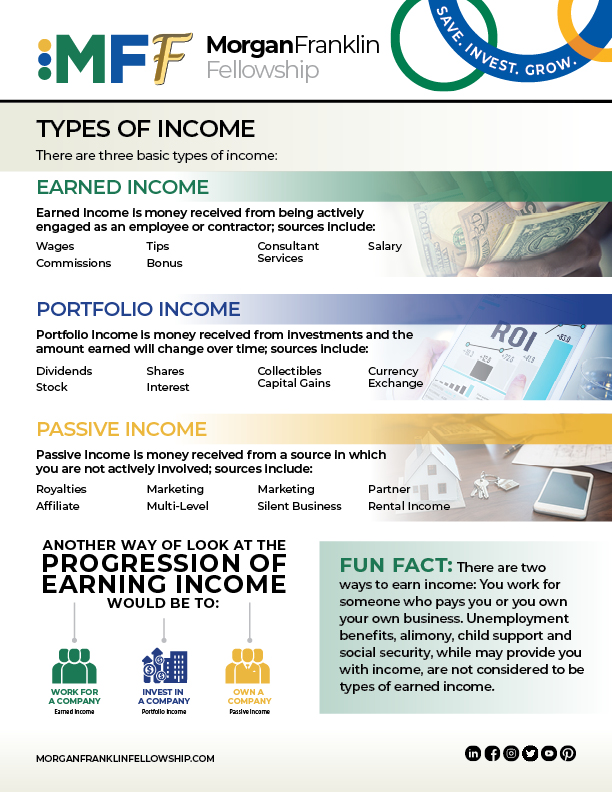

There are generally three types of income: earned income, portfolio income, and passive income.

Earned Income

This is income you have earned performing work. Sources of earned income include wages; salaries; tips; and other taxable employee compensation. The biggest benefit of earned income? Receiving a regular, consistent paycheck!

What’s not considered earned income? Pensions and annuities, welfare benefits, unemployment compensation, worker’s compensation benefits, or social security benefits are not considered earned income sources.

Earned income is generally taxable, although sometimes at different percentage rates, and is reported through the annual federal income tax process.

Portfolio Income

Portfolio income is money earned from investments, dividends, interest, and capital gains. For most, types of portfolio income include savings accounts, certificates of deposit, money market accounts, mutual funds, stocks and bonds. These are accounts where after your initial investment, there is very little day-to-day management or work involved to manage.

Portfolio income is often utilized when creating a more long-term plan for your future – whether it be a significant or large purchase, retirement or saving for college for children.

Passive Income

Passive income includes earnings recognized from a type of an investment such as rental property, limited partnership, or other business in which you may not be not actively involved but do provide you with an ongoing income. It is money you earn regularly with little or no effort on your part. If you are a landlord or a silent partner in a business, you are earning passive income.

A significant benefit of passive income is that while your day-to-day involvement in these activities is small, you do earn a steady income from the activity and can continue to pursue earned income opportunities. A downside of passive income is, unlike earned income, it needs time to grow and cannot be counted on to be a consistent – or quick – income.

![]()

A Journey to Personal Financial Success

At Morgan Franklin Fellowship (MFF), we support the concept of financial freedom – by teaching participants how to save by paying themselves first, invest for their future and grow their net worth.

Learning how money works and how to talk about money with others are the first steps towards recognizing an individual’s lifelong financial goals. Our online programs, podcasts, blogs, and book reviews and resources are designed to help you learn the concepts, rules and vocabulary of money, finance and investing.

Becoming an MFF Fellow

Our Standards of Financial Literacy – Learning about money series is engaging, full of interesting information, and easy to navigate. Adapted from the National Standards for Personal Financial Education developed by the Council for Economic Education (CEE), this robust curriculum features six short lessons on such important topics as earning income, understanding the value of saving and using credit. When completed, this program lays the foundation for becoming an MFF Fellow.

Becoming an MFF Fellow is the ticket to access additional MFF programs and opportunities for mentoring, networking, internships and real-world opportunities. Hear from the MFF Fellow themselves on how these opportunities encourage them to continue their journey to personal financial success.

Learn More about Money

Begin the journey towards personal financial independence today. START LEARNING TODAY