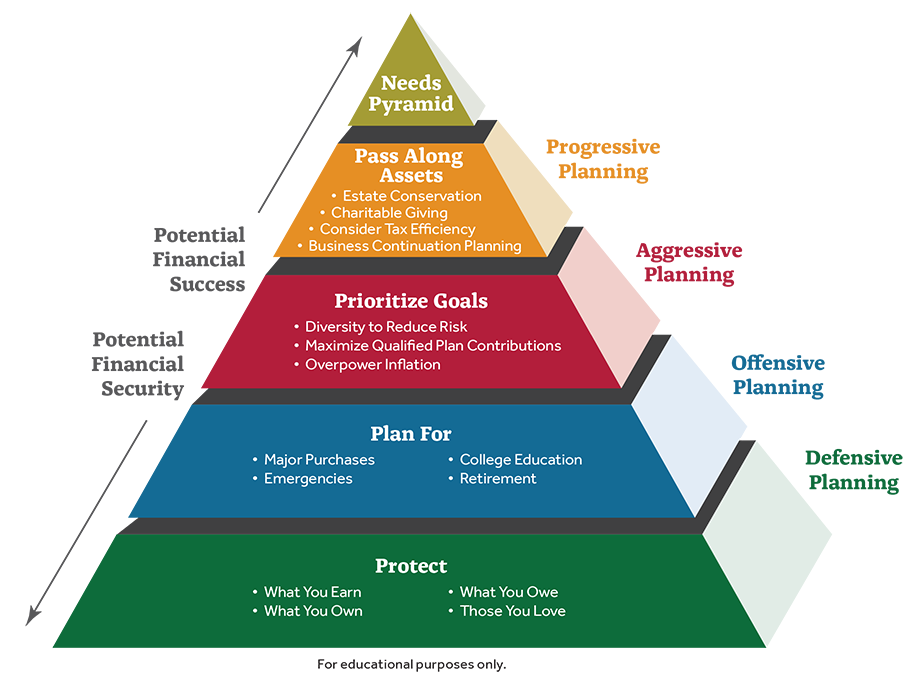

Financial needs change over time, and as we become more financially stable, we tend to move from one investment strategy to another. We move from protecting to planning and prioritizing, and finish up planning for the future.

Defensive Planning is about protecting what you have and what you earn. Most people in this category focus on how much they are earning, what they own, or what they owe. People implementing this strategy are usually in their first job or early in their career.

Defensive Planning is about protecting what you have and what you earn. Most people in this category focus on how much they are earning, what they own, or what they owe. People implementing this strategy are usually in their first job or early in their career.- Offensive Planning is about making investments such as buying a home, paying for college, and saving for retirement. People who use this strategy are usually well-established in their career and have a stable income.

- Aggressive Planning is about prioritizing goals, and making adjustments to meet retirement needs. People at this level are mid- to late-career, and are looking to manage current and future risks regarding their investments.

- Progressive Planning focus changes to maintaining a lifestyle and passing wealth on to the next generation. This investment strategy and is about putting plans in place to distribute personal and business assets and if needed, making sure business succession decisions are documented. People in this category are most likely in retirement.

Warren Buffet, an American investor, business tycoon, and philanthropist, is considered one of the most successful investors in the world with a net worth of over $100 billion in 2021. Warren Buffet’s best tips include:

- Invest in yourself and maximize your talent.

- Do research on a company before investing.

- Invest in income-producing assets.

![]()

A Journey to Personal Financial Success

At Morgan Franklin Fellowship (MFF), we support the concept of financial freedom – by teaching participants how to save by paying themselves first, invest for their future and grow their net worth.

Learning how money works and how to talk about money with others are the first steps towards recognizing an individual’s lifelong financial goals. Our online programs, podcasts, blogs, and book reviews and resources are designed to help you learn the concepts, rules and vocabulary of money, finance and investing.

Becoming an MFF Fellow

Our Standards of Financial Literacy – Learning about money series is engaging, full of interesting information, and easy to navigate. Adapted from the National Standards for Personal Financial Education developed by the Council for Economic Education (CEE), this robust curriculum features six short lessons on such important topics as earning income, understanding the value of saving and using credit. When completed, this program lays the foundation for becoming an MFF Fellow.

Becoming an MFF Fellow is the ticket to access additional MFF programs and opportunities for mentoring, networking, internships and real-world opportunities. Hear from the MFF Fellow themselves on how these opportunities encourage them to continue their journey to personal financial success.

Learn More about Money

Begin the journey towards personal financial independence today. START LEARNING TODAY