Goal setting is important because it keeps us focused on what we want to achieve.

Everyone has a different financial vision for the future, and that vision or dream may change over time. Reaching your financial vision is not something that happens without planning, nor does it happen overnight. In order to achieve your financial dream, you will need to set some goals.

- Short-term goals are usually accomplished within a year, and might include buying a new phone, buying new sports equipment, paying off debt, or experiencing travel adventures.

- Long-term goals care usually take longer than a year to accomplish and may include paying for college, owning your own home, retiring when you are ready, and being financially independent.

You may have more than one goal that you want to accomplish at the same time. For example, you may have two short-term goals and a long-term goal you are working on in the same year. Sometime you find yourself struggling to reach a targeted goals, not because of lack of effort, but because of how we organized our strategy.

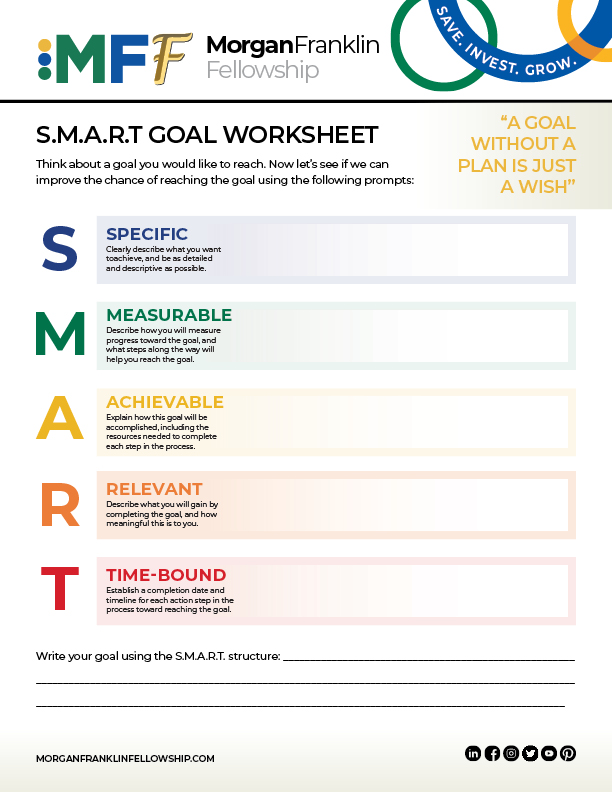

A good way to set goals is to create S.M.A.R.T. goals:

- Specific – clearly describe what you want to achieve, as well as why you want to achieve this goal. You should use words that are clear, and be as detailed as possible.

- Measurable – include how you will measure progress toward the goal, and how you will know that you have achieved the goal. This way, you can see if you are on track and can measure how much you still need before you reach your goal.

- Achievable – you need to make sure that this goal fits into your lifestyle and your budget. For example, you might only be able to save $100 each month for the first six months, and then you might be able to increase that amount so you can reach your goal sooner.

- Relevant – describe what you will gain from achieving the goal, including whether it is worthwhile. A goal needs to have value for you if you are going to commit time, money, and other resources towards reaching the goal. Identify if this goal will save you time or money in the future, and if it will bring you other things such as satisfaction, happiness, or the ability to do things you currently are not able to do.

- Time-bound – when you can measure each week or month where you are towards reaching your goal, you are more likely to achieve the results. Setting a realistic timeline is important, because if the timeline is too short and you cannot achieve the results you will get frustrated, and if it is too long you may forget to check in and measure your progress.

![]()

A Journey to Personal Financial Success

At Morgan Franklin Fellowship (MFF), we support the concept of financial freedom – by teaching participants how to save by paying themselves first, invest for their future and grow their net worth.

Learning how money works and how to talk about money with others are the first steps towards recognizing an individual’s lifelong financial goals. Our online programs, podcasts, blogs, and book reviews and resources are designed to help you learn the concepts, rules and vocabulary of money, finance and investing.

Becoming an MFF Fellow

Our Standards of Financial Literacy – Learning about money series is engaging, full of interesting information, and easy to navigate. Adapted from the National Standards for Personal Financial Education developed by the Council for Economic Education (CEE), this robust curriculum features six short lessons on such important topics as earning income, understanding the value of saving and using credit. When completed, this program lays the foundation for becoming an MFF Fellow.

Becoming an MFF Fellow is the ticket to access additional MFF programs and opportunities for mentoring, networking, internships and real-world opportunities. Hear from the MFF Fellow themselves on how these opportunities encourage them to continue their journey to personal financial success.

Learn More about Money

Begin the journey towards personal financial independence today. START LEARNING TODAY