5 Ways to Increase Your Income

Your Road to Financial Freedom Begins with a Consistent Income. There are a number of other ways to increase your earning potential including: Advance career opportunities over time – You may be fortunate enough to stay in one career or with one employer for many years. However, the average person will change careers 5 to 7 […]

Financial Risk: More Than a Game of Strategy

Financial risk tolerance is simply a measure of how much of a loss an investor is willing to endure within a portfolio and his or her willingness to accept higher risk in exchange for the possibility of higher returns. Financial risk tolerance looks at how much market risk—stock volatility, stock market swings, economic or political […]

5 Reasons to not keep cash under your mattress

Financial institutions are companies focused on providing financial and monetary transactions such as deposits, loans, investments, and currency exchange. Why should you use a financial institution to manage your financial transactions? Here are five key reasons to do so: Safety: It’s risky to keep your money in cash. It could easily get lost, stolen, or […]

What Type of Insurance Do You Need?

Facts About Insurance A risk is something that exposes us to danger, harm, or loss. We face risks every day, and often these risks can have a financial impact on our lives. Getting sick, breaking a leg, having a car accident, or experiencing a house fire are examples of risks that may happen to any […]

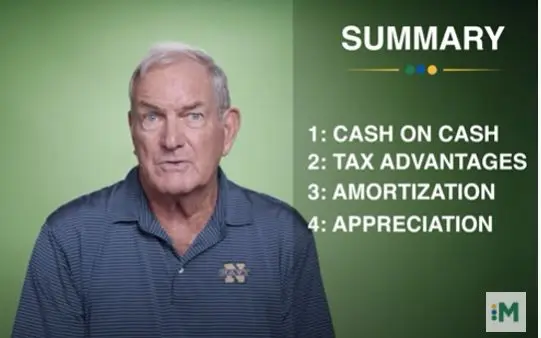

Four Benefits of Real Estate Investing

The benefits of investing in real estate as a way to build wealth are many. When investing in the right property, investors can enjoy predictable cash flow, excellent returns, tax advantages, and diversification. Four Benefits of Real Estate Investing are: Cash-on-cash – This measures as a percentage the cash income earned on the cash invested […]

5 Ways FICO Calculates Your Credit Score

A credit score is a three-digit number that identifies how risky you are to a lender. One Little Three-Digit Number You may not even know you have one. If you have a utility (electricity, phone, etc.) account, a credit card, a student loan, a car payment or a mortgage, you’ve got one. You’ve got a […]

How To Buy with Credit

What’s on your list of things you may want to purchase soon? Perhaps it’s new furniture, a car or a home. Or it could be a student loan for yourself or your child. Using Credit For most of us, this will mean financing the purchase by using some form of credit. Purchasing something “on credit” […]

Compound Interest – The 8th Wonder of the World

Albert Einstein once said “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”. Understanding Simple & Compound Interest Interest is the cost of using somebody else’s money. When you borrow money, you pay interest. When you lend, or invest, money, you earn interest. Interest is […]

Developing a “Saving Money” Mindset

Let’s face it, creating and maintaining a money saving mindset can be difficult. Developing a “Saving Money” Mindset It may not be easy. It may mean making difficult decisions. It can take time. It requires discipline. But the benefits can be life-changing and provide you with a certain sense of security and peace-of-mind. It is […]

Making Your Financial Goals S.M.A.R.T.

Making Your Financial Goals S.M.A.R.T. “Preparation is the key to success.” ~ Alexander Graham Bell Setting goals, including financial goals, not only provides you direction and gives you control of your future, can give you a great sense of personal satisfaction. Reaching your goals is possible when they are S.M.A.R.T. – Specific, Measurable, Achievable, Relevant, […]